What is a living wage?

A living wage reflects what earners in a family need to bring home based on the actual costs of living in a specific community. Living wages are rooted in the belief that individuals and families should not just survive, but be able to live in dignity, and participate in their community. The living wage is defined as the hourly wage a worker needs to earn to cover their basic expenses and participate in the community.

When does the new living wage get announced and when does it have to be implemented?

VCC announces Calgary's living wage annually during Living Wage Week in November. Employers are encouraged to implement new numbers as soon as possible. Typically, we require certified employers to adjust the minimum hourly wage within 6 months following the announcement, but because 2022's rate increase was higher than in past years, employers will have one year to adopt the new living wage to remain accredited.

What is the difference between a minimum wage and living wage?

The minimum wage is the legislated minimum set by the provincial government. Thousands of families making the current minimum wage in Alberta are still living below the poverty line and are unable to lift themselves out of poverty. A living wage calls on employers to ensure that workers are paid a fair wage within their community, and that reflect the true costs of living in a community and that parents can earn what they need to support their families.

Some key differences:

- The minimum wage is the same across the province. Living wage reflects what people need to earn to cover the actual costs of living in their community.

- The minimum wage is mandatory for many occupations. The living wage is a voluntary commitment of employers to go beyond the minimum standard and pay enough for employees to cover their expenses and participate in community.

- For years the minimum wage has been too low to lift even someone working full-time above the poverty line. The living wage is based on the principle that if you work full-time for a full year, you should earn enough to make ends meet and participate in your community.

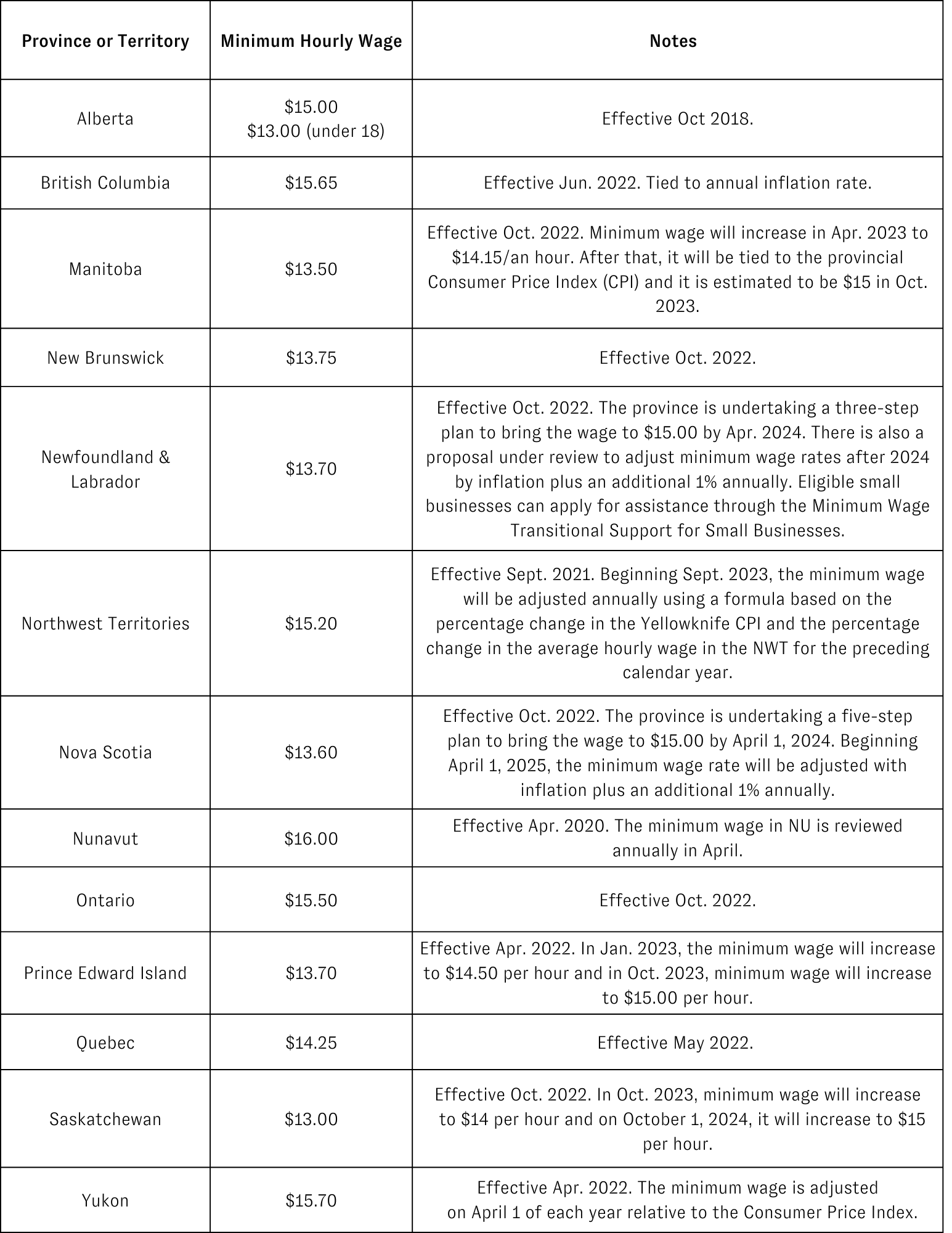

What is the minimum wage in 2022 in Alberta?

The minimum wage set by the provincial government is typically lower than the living wage. It is:

- $15.00 per hour

- $13.00 per hour for students under the age of 18

The last time minimum wage was changed was on October 1, 2018 when minimum wage was raised from $13.60/hour to $15/hour. On June 26, 2019, the Alberta government implemented a new minimum wage of $13/hour for students under 18. In comparison, BC raised minimum wage to $15.75 on June 1, 2022 and Ontario raised minimum wage to $15.50 on October 1, 2022. All provinces and territories, except for Alberta, have increased minimum wage in 2021 or 2022.

How was the living wage calculated?

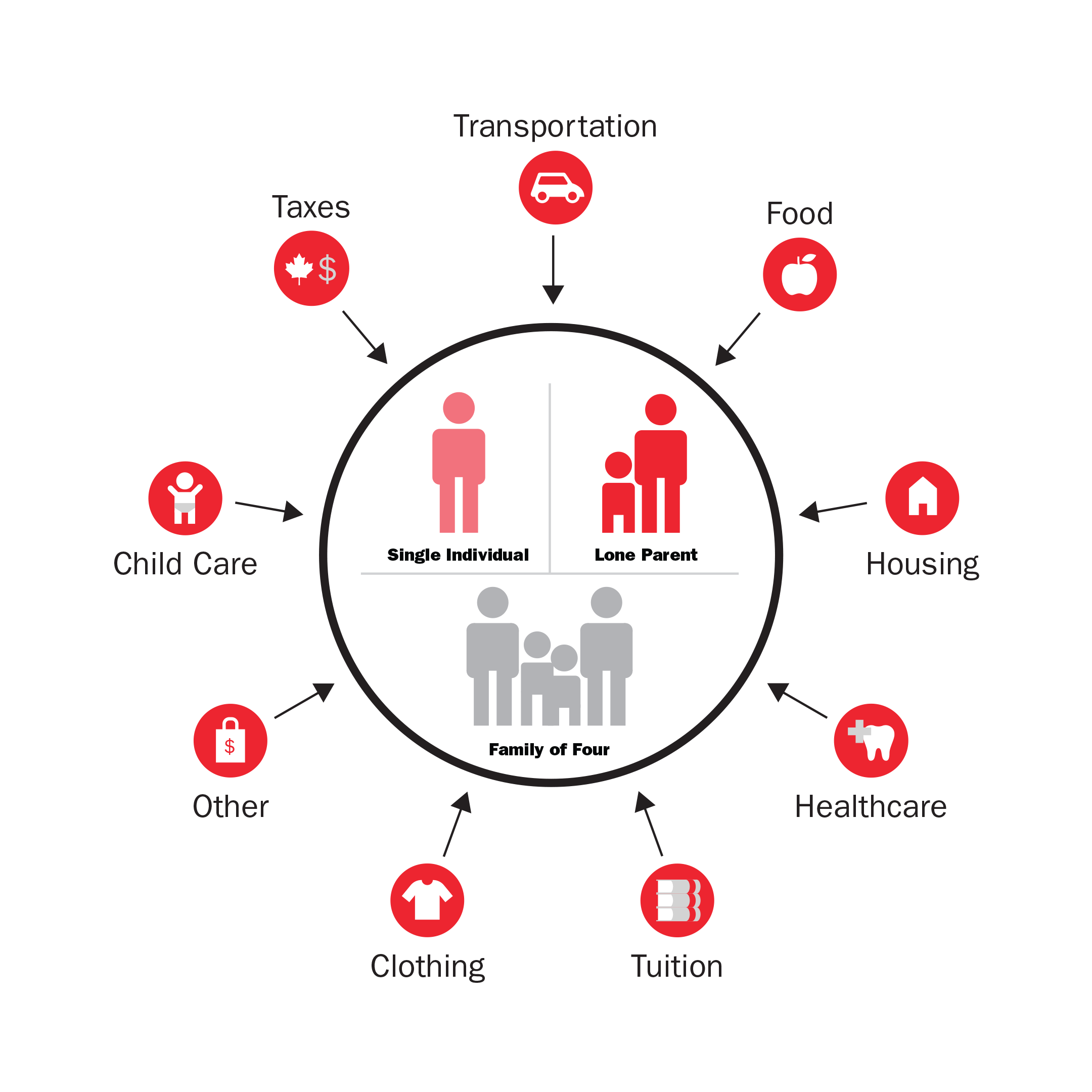

The living wage is based on the income needs of the following three household types:

- a two-parent family with two young children,

- a lone parent family with one young child,

- a single individual living alone.

It is a weighted average based on how many of each household type there are in Alberta. It considers the hourly rate of pay needed for a household to maintain a modest standard of living once government transfers have been added to the family’s income and taxes have been subtracted. The methodology assumes that each adult is working full-time hours and includes more than the basics of food, clothing, and shelter. The calculator also takes into account unexpected costs, small investments in education, child care, and participating in the community.

Why has there been such a big jump from 2021's living wage to 2022's?

Some communities saw a bigger increase in their living wage rate between 2021 and 2022 than previous years for the following reasons:

- There has been record inflation rates, which means the prices of goods and services have increased more than usual.

- The living wage rates in 2021 and previously have usually been based on the income needs of a family of four; in 2022 we broadened it to be based on three household types: (1) a family of four, (2) a lone parent family with one young child, and (3) a single individual living alone. The income needs for a lone parent family and a single individual living alone can often be higher than for a family of four with two working adults, so this would push the living wage higher compared to previous years.

- We made some additions to be more consistent with how Ontario and BC calculate their living wages. For example, we’ve added an amount for life and critical illness insurance and increased mobile services to include 5GB of data on a 4G network.

I'm an employer and I can't afford to raise my payroll this much. What can I do?

Businesses have faced unprecedented challenges over the past two years. The intention of releasing living wages is not to add further stress to these companies, but to shed some light on what it actually costs to live in Alberta. Calculating and publishing living wages helps inform businesses as well as policymakers about local affordability measures and how they compare to other cities and provinces. Equipped with this information, businesses can advocate for measures like utility rate caps, insurance premium caps as well as action on affordable housing and food.

If businesses are expected to increase wages, won’t they have to lay people off?

Studies show that businesses usually absorb cost increases related to living wage policies through a combination of price and productivity increases, reduced turnover and redistribution of staff. When B.C. raised its minimum wage more than $2 per hour in a relatively short amount of time, there was a very small (1.6%) reduction in the employment rate for youth between the ages of 15 and 24 and we can’t be sure that this 1.6% reduction was entirely due to the change in minimum wage or if there were other factors.

There are a lot of examples of cities raising wages, including Vancouver, Seattle, and London in the UK. In these jurisdictions, increases in wages for the lowest paid in society actually resulted in increased spending power and reduced inequality.

What is the certification process?

Employers around Alberta can apply to be certified with the Alberta Living Wage Network.

How do organizations benefit from paying living wages?

There are several reasons that employers pay living wages across the province and in Canada, these include happier workers, less turnover, and fewer missed work days. Many also consistently report that they feel it’s the right thing to do.

Research has found that living wage employers also cut costs when it comes to hiring and training new employees. A Harvard Business Review article compared the turnover rate of two employers one paying living wages and one that didn't - they were 17% and 44% respectively. The report also stated that the cost of replacing a worker was 1.5 to 2.5 times the worker’s salary.

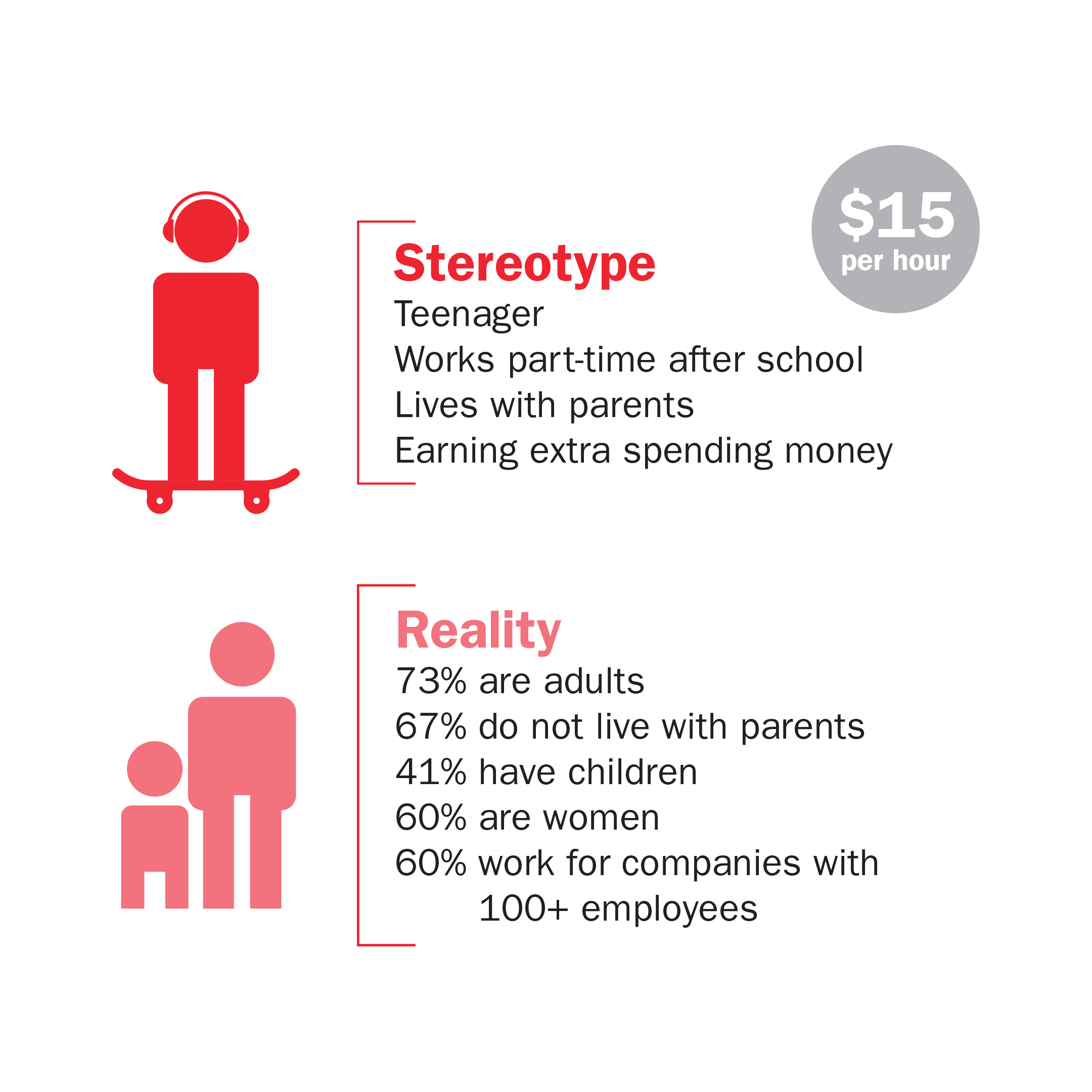

Most people making lower wages are kids living with their parents; shouldn’t they be paid less because they have fewer expenses?

It’s important to note that most people that earn between $13 (minimum wage for people under the age of 18) and $19 (typical Alberta living wage) are not kids living at home. Approximately 45% have children and 59% are over the age of 25, according to the most recent StatsCan Labour Force Survey – September 2020 to August 2021. In fact, according to the most recent Alberta Minimum Wage Profile, of those making minimum wages in our province 73% are adults and 41% have children.

Why are three family types used to calculate the living wage? What about people in different living situations?

Each person’s living situation is unique, and the living wage rate isn’t meant to be an exact representation of each individual’s circumstances. The living wage is an indicator for community affordability and livability based on the best data available for each community. We included three family types to reflect situations where income earners have access to different government benefits and taxes and would be affected differently by policy changes (e.g., improving child care affordability will affect each household type differently).

Calculating and publishing different living wages for different family types could be confusing and could create conditions where employers are asking employees about family situations for different wage structures.

Inflation keeps going up, won’t raising wages continue raising inflation?

This 2017 Bank of Canada staff analytical note looked at what would happen if provinces went ahead with their scheduled minimum wage increases (e.g., Alberta was scheduled to increase minimum wage from $12.20 to $13.50 in October 2017 and then to $15 in October 2018). They found that the scheduled minimum wage increases would contribute to inflation by roughly 0.1 percentage points in 2018. This means that when the lowest paid workers get a raise, it has a very small effect on the prices of goods and services.

If wages go up, won’t I be paying more for goods and services?

Costs rise all the time without workers receiving a pay increase. Living wage policies cover only a small percentage of the labour force. When Seattle committed to raise their minimum wage to $15 per hour, researchers started studying consumer prices for goods. They found that the increase in minimum wage had no impact on the prices of goods and that costs went up by the same amount in Seattle as they did in surrounding communities that didn’t see a raise to their minimum wage. Check out the University of Washington Minimum Wage Study for more information.