You have all seen the neon lights of an insta-loan or quick-cash store. Perhaps you have even had to borrow from one and learned how staggeringly high the cost is. For a payday loan in Alberta, you pay about 400% annual interest. For an installment loan, you might pay around 60%, plus other additional fees and costs.

When someone is drowning, you do not throw them an anchor. Yet, Canada’s current allowable interest rate is a crushing weight to those experiencing financial hardship and in need of credit.

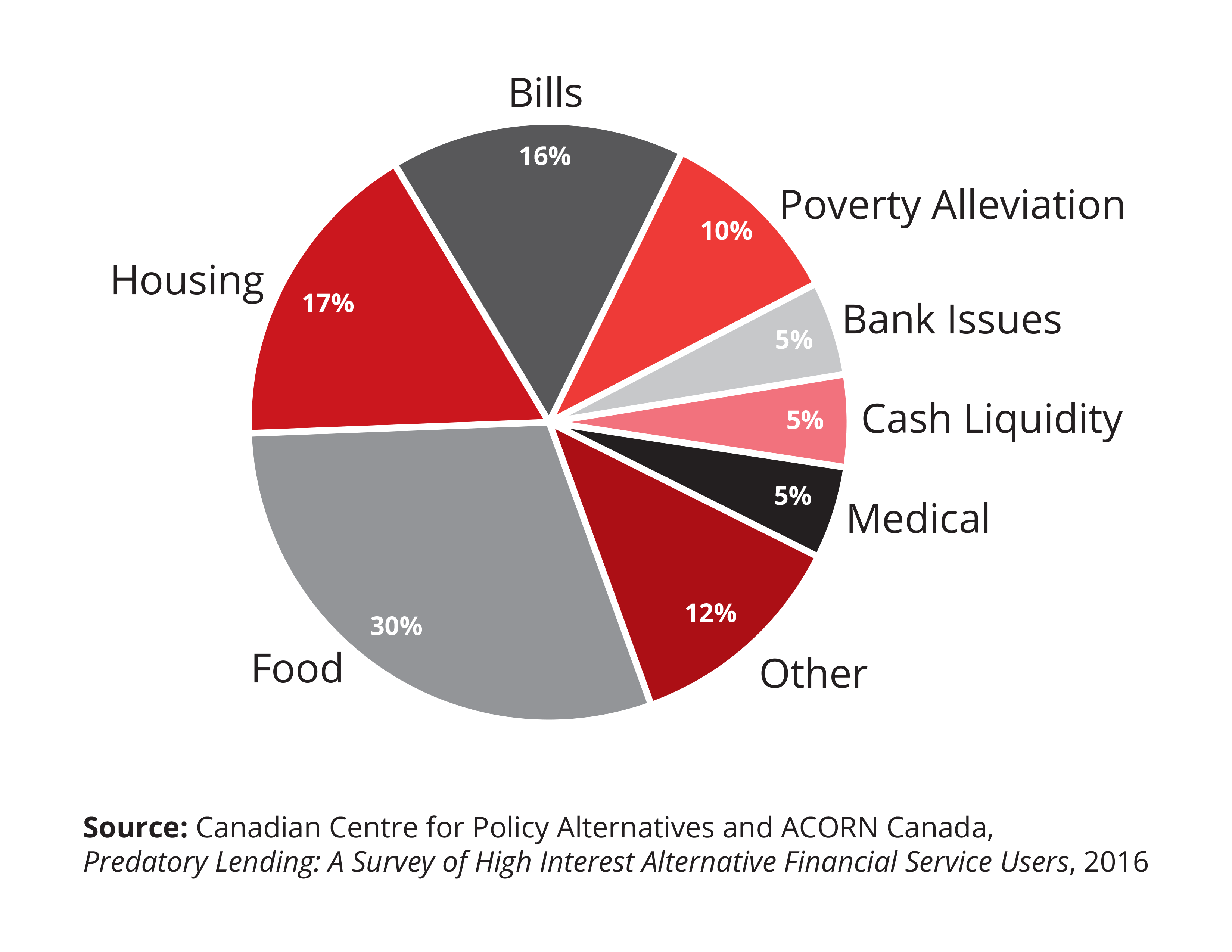

The current allowable rate harms the financial wellness of families and communities as scarce financial resources go to servicing debt instead of being spent at small businesses and on goods and services that improve people’s well-being. Most people accessing a fringe loan are simply trying to cover the cost of basic needs.